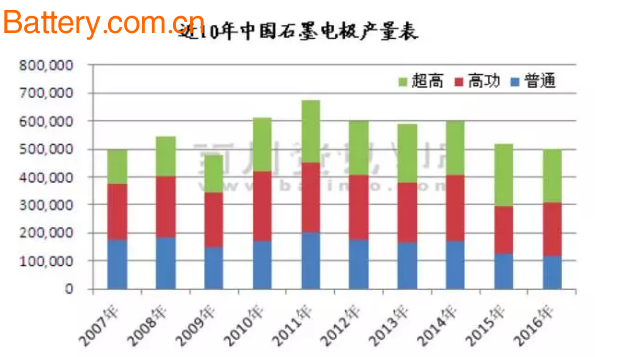

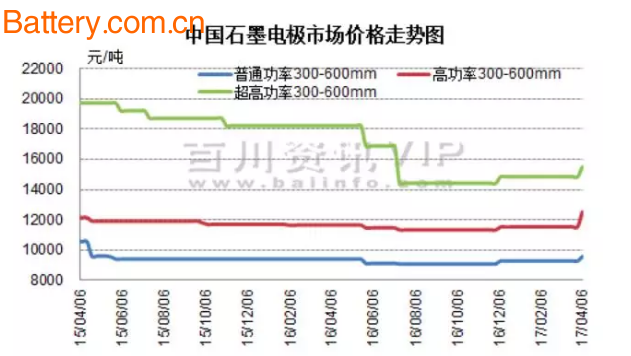

In 2017, China's graphite electrode market will become more rational. Due to environmental factors and other factors, production will be reduced. With the small increase in downstream demand and the expected increase in raw material costs, the price of graphite electrodes has increased. In 2016, the production of graphite electrodes in China is still in a downward trend. The reason is mainly due to the continued downturn in downstream demand. 1) The operating rate of downstream metal silicon continues to be low, and some factories have been completely shut down. The downturn in the metal silicon industry is difficult to drive the trend of the graphite electrode market. 2) In 2016, China's steel industry still experienced the wave of “de-capacityâ€. The downstream supply of graphite electrodes is still limited. The orders on the market are limited, and it is trapped under the pressure of returning. Some graphite electrode enterprises are in a conservative production order. Mode to prevent inventory increase. First, the price factor affecting the graphite electrode In 2016, graphite electrodes were in a downtrend before the fourth quarter. After the fourth quarter, the price showed a small test increase. There are two reasons for the rise: 1. Reduction in supply Since 2014, the output of graphite electrodes has continued to decline. In 2016, due to the environmental impact of some small enterprises (such as Hebei and Henan), the price of graphite electrodes has been in a downturn for some enterprises with poor capital conditions to stop production. The decrease in supply has driven up prices. 2. The rise in cost price The cost of raw materials, natural gas, coal, coal and bitumen prices have risen, resulting in an increase in the cost of graphite electrodes, and the price of some of the tight-fitting graphite electrodes has risen. Second, the supply of graphite electrodes Because the vicious competition in the market is more serious, the competition between enterprises makes the price of graphite electrode bottoming out or even lower than the cost price in the third quarter of 2016, and the range is wide. Some enterprises with weak competitive strength will choose to stop production or reduce production due to financial pressure. In addition, in the early stage, due to the sluggish market, the enterprises that stopped production and maintenance failed to resume work in the later stage, and the industry's capacity utilization rate was low. In 2016, the monthly output was between 39,000 and 45,000 tons, and the monthly output was basically stable. Since September 17, 2016, due to environmental protection and rectification of production and production, the affected capacity is 110,000 tons/year, resulting in a decrease of 3,000 tons per month. Third, the downstream demand situation In 2016, the proportion of electric steel production fell, and the metal silicon operating rate continued to be low. The downstream demand did not have a favorable factor. 1. Export At present, China has become the world's largest producer and seller of graphite electrodes. Its output accounts for 39.21% of the total output of graphite electrodes in the world. There are 6 production capacity of more than 100,000 tons worldwide. There are two large carbon and Jilin carbon in China. It is understood that most of the global electric steelmaking steel production is abroad, and China's production accounts for less than 20%. But in stark contrast, more than 50% of the world's graphite electrode production is in China. Therefore, the imbalance between production and consumption areas, coupled with the oversupply in the domestic market and the large imbalance in supply and demand in the product structure, have prompted graphite electrode manufacturers to attach great importance to the export market. In 2016, China's graphite electrode exports were 160,954 tons, down 4.78% year-on-year, and exports accounted for 32% of total production. 2, domestic Steel mills: In 2016, steel mills were affected by “de-capacity†on the one hand, production declined, and demand for graphite electrodes decreased. Although the price also showed an increase, the operating rate did not increase, which did not bring good demand for graphite electrodes. Metal silicon: In 2016, the operating rate of China's metal silicon has been relatively low. From the monthly operating rate, it is basically between 21% and 35%. Metal silicon started construction in the first half of the year, and February is the traditional Chinese calendar year. The New Year's atmosphere is strong, the market starts to be the lowest in the whole year, and then with the gradual arrival of the wet season, the total operating rate of metal silicon is slowly rising. After June, the operating rate of metal silicon is mainly stable. Lower operating rates are lower for general power graphite electrodes. Fourth, the development of graphite electrodes in 2017 In 2017, the demand market is the key factor in the price trend of the leading graphite electrode. With the downstream demand gradually increasing, the supply cycle is reduced, the graphite electrode settlement cycle is shortened, and the capital is good with 2016. 1. Raw materials Since needle coke has been widely used in the anode material market in recent years, the demand for needle coke has greatly increased, and the needle coke market has formed a favorable market. In 2017, the price of needle coke will increase by 10%. 2, the production aspect In 2016, the monthly operating rate of graphite electrodes is around 50%. In the second half of the year, affected by environmental protection enterprises and the shortage of funds, it is expected that the output of graphite electrodes will continue to decrease in 2017 or be in line with 2016. 3, the demand side Metal silicon: Considering the cost of raw materials and downstream demand, the price of metal silicon in 2017 is mostly rational, and there will be no big ups and downs. The start-up situation will be the same as in 2016, so the ordinary graphite electrode and carbon electrode The demand will also be basically the same as in 2016. Steel mills: With the deepening of the reform on the supply side, open hearth steelmaking will withdraw from the market. In 2017, the demand for electrode growth is more than that of some open furnaces. The output of open hearth steelmaking is not nearly 100 million tons in China. Among them, 4-5 million tons will be eliminated, and some of them are electric furnaces at the time of approval, but these enterprises that are on the open hearth are being rebuilt, and some are going to change the electric furnace's approval process (it takes a certain time, and Unknown can be changed to). To sum up: China's graphite electrode market will become more rational in 2017, due to environmental factors and other factors, production will be reduced. With the small increase in downstream demand and the expected increase in raw material costs, the price of graphite electrodes has increased. In addition, in May, the low-sulfur coke in the northeast region was intensively repaired. At that time, the low-sulfur petroleum coke resources were in a state of tension, and the increase in cost pushed the price of graphite electrodes to rise. Harmonize Lines Constant Force Actuator Our harmonizing lines Force Control System, Harmonizing lines Constant Force Actuator, Harmonizing lines active contact flange have many advantages over other grinders. It can realize flexible grinding, quick repsond to surface changing, and instant adjusting. Traditional mechanic hand lacks flexibility, and it is not easy to adjust, hard to realize mass production. Harmonizing lines constant force actuator,Harmonizing lines active contact flange,Harmonizing lines force control system DARU Technology (Suzhou) Co., Ltd. , https://www.szconstantforceactuator.com